The Editing Apps That Won Photographers Over in 2023

Cyme makes macOS software for photographers, including Avalanche and the photo cataloging app Peakto. Whereas Peakto helps photographers organize their photos across multiple locations and apps, Avalanche allows users to migrate their photos from one editing app to another easily.

Thanks to Avalanche and the way customers use it, Cyme can see how users transfer images from one app to another, reflecting which apps photographers use to edit their images. Avalanche is available in different versions for specific editing applications. For example, Avalanche for Lightroom can convert any Aperture, Capture One, Luminar, iView Media Pro, Apple Photos, and Google Photos catalog to Lightroom while retaining edits, metadata, and folder structure. There’s also Avalanche Unlimited, which costs more but works with each supported target app.

There are limitations to the data set, of course. While Cyme knows how many versions of Avalanche it has sold for each target application, it is only available for Lightroom, Capture One, Luminar, and Apple Photos. People use other apps, like DxO PhotoLab and ON1 Photo RAW, for example. Plenty of people never change their editing app of choice, so there’s no need to purchase Avalanche.

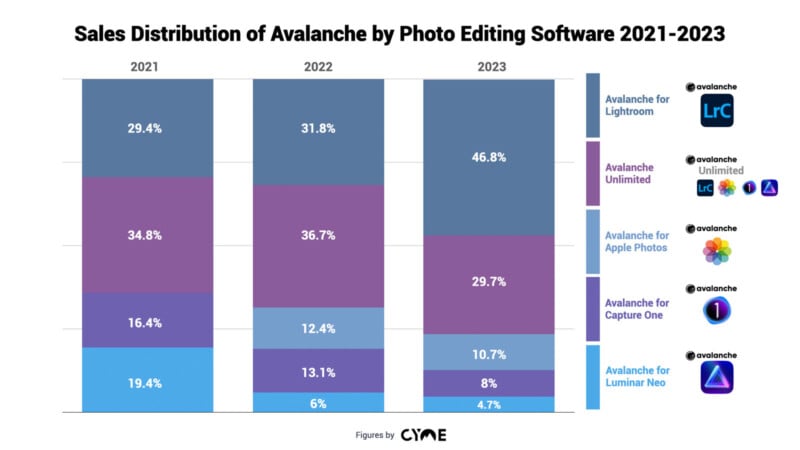

These caveats aside, it is possible to discern general trends among photographers using sales data from 2021, 2022, and 2023. These trends align reasonably well with anecdotal evidence PetaPixel has gathered chatting with photographers about their editing apps in recent years.

Notably, a higher proportion of customers are buying Avalanche for Lightroom each year, meaning that these users are switching to Lightroom from a different photo editing application at relatively higher rates. While the Lightroom user share has gone from 29.4% to 46.8% from 2021 to 2023, sales of Avalanche for Capture One have dropped from 16.4% to 13.1% and then to just 8% last year.

As for Avalanche for Luminar Neo, it accounted for 19.4% of Avalanche sales in 2021, three percentage points more than Capture One. The appeal of Luminar Neo’s intriguing AI-powered and computational features lost a lot of steam in 2022 when sales dipped to 6%. They were at 4.7% last year.

The trend among macOS users switching from one photo editing app to another using Avalanche is that people gravitate more toward Lightroom than any other photo editing app, which isn’t too surprising. However, the increasing rate at which users switch to Lightroom, which has long been the most popular photo editing app, is surprising.

In Cyme’s full breakdown of Avalanche sales data, the company recaps what arrived in 2023 on each photo editing app.

Lightroom’s AI-based masking tools continue to improve, and as much as it ever has been, Lightroom is now a viable alternative to using Photoshop to edit photos. Many photographers can do everything they need within Lightroom, from importing, culling, editing, and printing images.

As for Luminar Neo, Skylum has been getting involved in generative AI technology and making some interesting choices concerning a move to a subscription model. Once supremely popular, Capture One has also gone all-in on subscription pricing and finally launched Capture One on iPhone this year, although the app isn’t great.

Cyme also tapped into its Peakto user base to learn more about photo editing software preferences. Among surveyed Peakto owners, photographers own an average of about four photo editing and management applications. DxO Photolab, Pixelmator’s apps, Affinity Photo, and ON1 software received high marks from Peakto users.

Image credits: Header photo licensed via Depositphotos. Data and figures provided by Cyme.